As experienced stock traders, our approach adapts to the changing tides of the market. In bull markets, our strategy is to buy and hold, whereas in bear markets, we pivot to a more active stance, buying and trading. December has started with clear signs of bullish momentum, an aspect that is always a key focus in our analysis.

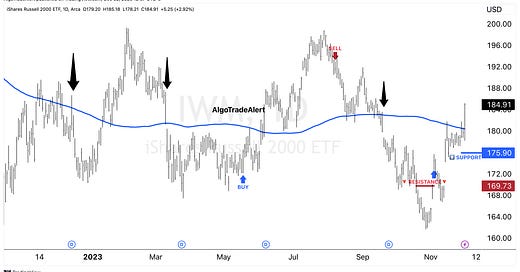

Broad Market Strength as a Bullish Indicator One of my favorite indicators, Broad Market Strength, was prominently on display as we entered December. This was partly due to a breakout move in the Russell 2000, as seen in the IWM ETF Stock Chart Below. The significance of strong market breadth lies in its indication of the robustness of the liquidity stream. When even the smaller caps, often considered the least deserving issues, are receiving a share of the investment, it signifies a healthy and abundant flow of capital. This scenario often creates a persistent condition that propels the market forward.

Keep reading with a 7-day free trial

Subscribe to Daily Stock Market Update to keep reading this post and get 7 days of free access to the full post archives.