Stock Market Update Thursday March 27, 2025 It was a subdued trading session for the stock market, with multiple futile rally attempts ultimately leading to another decline across major indices. The S&P 500 (SPX) remains under pressure, trading below its 200-day moving average, a key technical level watched by investors.

Market Performance Recap:

S&P 500 (SPX): ▼ 0.3%

Nasdaq-100 (QQQ): ▼ 0.6%

Russell 2000 (IWM): ▼ 0.4%

Sector & Stock Movers

🔻 Decliners:

General Motors (GM) plunged 7.4%, as new automaker tariffs weighed heavily on sentiment, dragging down Ford (F) and other industry peers.

Applovin (APP) tumbled 20%, wiping out recent gains in a sharp correction.

Semiconductors saw broad weakness, with Nvidia (NVDA), Broadcom (AVGO), and Advanced Micro Devices (AMD) extending their losses.

✅ Gainers:

Defensive retail stocks outperformed, with Dollar Tree (DLTR), Dollar General (DG), and AutoZone (AZO) posting gains, as investors rotated into consumer staples and discount retailers amid economic uncertainty.

Away From Stocks: Long-dated Treasurys remained under pressure, with 10-year and 30-year yields climbing three and four basis points, respectively, to 4.38% and 4.73%. Meanwhile, WTI crude edged higher, approaching $70 per barrel, while gold surged over 1% to $3,057 per ounce, reflecting a flight to safety. Bitcoin held steady near $87,000, and equity market volatility remained subdued, with the VIX settling just below 19.

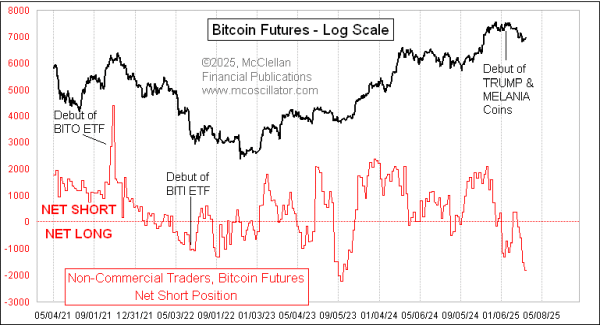

I've been a subscriber to the McClellan Newsletter for over a decade and highly recommend their newsletters. If you sign up, they will email you a free publication called "Chart in Focus," which I received today.

The "non-commercial" category of Bitcoin futures traders in the COT Report data has shifted to a significant net long position. This indicates that Bitcoin prices are likely reaching a bottom. You can click the link below to read the rest of the article.

Keep reading with a 7-day free trial

Subscribe to Daily Stock Market Update to keep reading this post and get 7 days of free access to the full post archives.