Stock Market Update Thursday February 13, 2025 Although the Producer Price Index (PPI) report was better than anticipated, both stocks and bonds did surprisingly well because traders spotted indications of disinflation in the data. This optimism about potentially lower Personal Consumption Expenditures (PCE) in the upcoming weeks encouraged more risk-taking. The strong bull market continued without signs of slowing down, with equities making gains and the S&P 500 rising over 1%, approaching its peak from January 23.

Away From Stocks: Treasury yields stabilized after the selloff following Tuesday's CPI report, with the 10-year yield decreasing from 4.54% to 4.52%. In the commodities market, WTI crude oil stayed below $72 per barrel. Gold prices rose nearly 1%, reaching $2,929 per ounce, as investors continued to hedge against inflation. Bitcoin remained strong, trading above $96,000 and keeping its upward trend. Additionally, market volatility decreased, with the VIX dropping just under a point to 15.

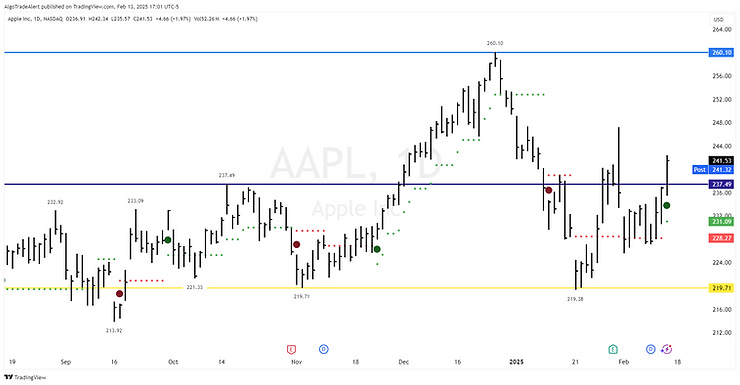

Market Breakouts and Inflation Outlook

Today, the markets are seeing strong gains, with the S&P 500 SPY ETF and the Nasdaq 100 QQQ ETF closing above key resistance levels. We now need to observe a week of bullish consolidation before the markets can rise further. It's also important to highlight that the Equal-Weighted S&P 500, Dow Jones Industrial Average (DJIA), Dow Jones Transportation Index (DJ Transports), and Russell 2000 (IWM) have not yet confirmed this upward trend. This suggests that the rally is mainly driven by large-cap tech and growth stocks.

Keep reading with a 7-day free trial

Subscribe to Daily Stock Market Update to keep reading this post and get 7 days of free access to the full post archives.