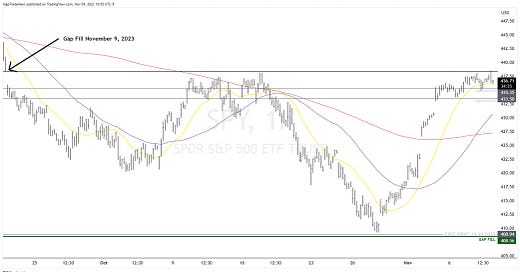

Stock Market Update Thursday November 9, 2023 Equities Retreat After Remarkable Rally The Market’s Momentum Meets a Turning Point Following an impressive sequence of nine consecutive days of gains, the stock market opened to a change in sentiment. Sellers came to the forefront almost immediately as trading began. This initial softness in buying enthusia…

Keep reading with a 7-day free trial

Subscribe to Daily Stock Market Update to keep reading this post and get 7 days of free access to the full post archives.